The Acquisition

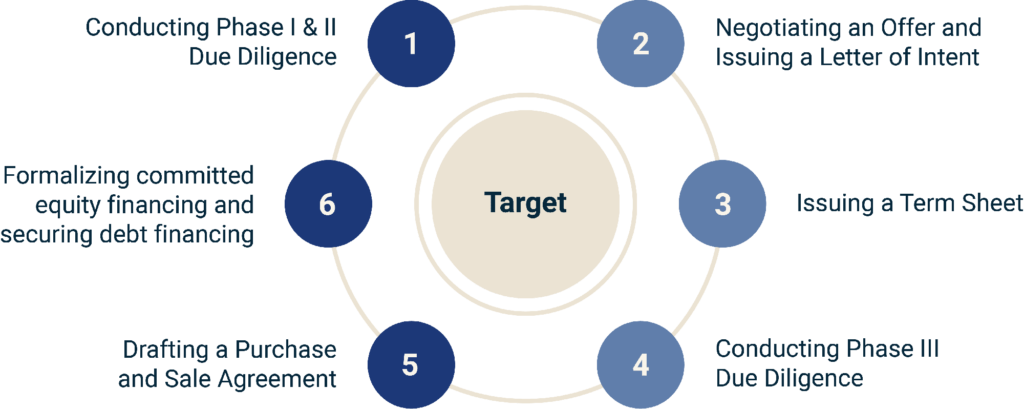

Once an attractive target company is identified, the closing process normally requires:

- Conducting Phase I & II Due Diligence

- Negotiating an Offer and Issuing a Letter of Intent

- Issuing a Term Sheet

- Conducting Phase III Due Diligence

- Drafting a Purchase and Sale Agreement

- Formalizing committed equity financing and securing debt financing

At vero eos et accus amet re justo duo dolortrem volute

Lorem ipsum dolor sit amet, consetetur sad ips cingelitr, sed diam nonumy eirmod temp rinvidunt utlabore et dolore magna aliquyam erat, sed diam vluptua. At vero eos et accus amet justo duo dolortrem volute reu.

At vero eos et accus amet re justo duo dolortrem volute

Lorem ipsum dolor sit amet, consetetur sad ips cingelitr, sed diam nonumy eirmod temp rinvidunt utlabore et dolore magna aliquyam erat, sed diam vluptua. At vero eos et accus amet justo duo dolortrem volute reu.

At vero eos et accus amet re justo duo dolortrem volute

Lorem ipsum dolor sit amet, consetetur sad ips cingelitr, sed diam nonumy eirmod temp rinvidunt utlabore et dolore magna aliquyam erat, sed diam vluptua. At vero eos et accus amet justo duo dolortrem volute reu.

At vero eos et accus amet re justo duo dolortrem volute

Lorem ipsum dolor sit amet, consetetur sad ips cingelitr, sed diam nonumy eirmod temp rinvidunt utlabore et dolore magna aliquyam erat, sed diam vluptua. At vero eos et accus amet justo duo dolortrem volute reu.

At vero eos et accus amet re justo duo dolortrem volute

Lorem ipsum dolor sit amet, consetetur sad ips cingelitr, sed diam nonumy eirmod temp rinvidunt utlabore et dolore magna aliquyam erat, sed diam vluptua. At vero eos et accus amet justo duo dolortrem volute reu.

At vero eos et accus amet re justo duo dolortrem volute

Lorem ipsum dolor sit amet, consetetur sad ips cingelitr, sed diam nonumy eirmod temp rinvidunt utlabore et dolore magna aliquyam erat, sed diam vluptua. At vero eos et accus amet justo duo dolortrem volute reu.

Disclaimer

Before investing, you should carefully consider Hourglass Partners’ (the "Fund“) investment objectives, risks, charges and expenses. This and other information is in the Fund’s Investor Memorandum, a copy of which may be obtain via email to rsewell@sewelllegal.com. Please read the Investor Memorandum carefully before you reach out or invest.

Investments in the Fund are speculative and illiquid, involving substantial risk of loss. An investment in the Fund is appropriate only for those investors who do not require a liquid investment, are able to financially support the full loss of their investment, and who fully understand and can assume the risks. The Fund could experience fluctuations in its performance due to several factors. As a result of these factors, results for any previous period, sector data, or other sources should not be relied upon as being indicative of performance in future periods.

The Fund Investments may include performing companies, acquired assets, mezzanine financing and stressed companies. Such investments involve substantial, highly significant risks. The Fund may employ leverage through borrowings or acquire interests in companies with leveraged capital structures. The overall performance of the Fund's investments will depend in large part on the acquisition price paid, which may be negotiated based on incomplete or imperfect information. For a complete discussion of risks please review the Investor Memorandum carefully.

Existing logistics business to take on

and grow business

Disclaimer

Before investing, you should carefully consider Hourglass Partners’ (the "Fund“) investment objectives, risks, charges and expenses. This and other information is in the Fund’s Investor Memorandum, a copy of which may be obtain via email to rsewell@sewelllegal.com. Please read the Investor Memorandum carefully before you reach out or invest. Investments in the Fund are speculative and illiquid, involving substantial risk of loss. An investment in the Fund is appropriate only for those investors who do not require a liquid investment, are able to financially support the full loss of their investment, and who fully understand and can assume the risks. The Fund could experience fluctuations in its performance due to several factors. As a result of these factors, results for any previous period, sector data, or other sources should not be relied upon as being indicative of performance in future periods. The Fund Investments may include performing companies, acquired assets, mezzanine financing and stressed companies. Such investments involve substantial, highly significant risks. The Fund may employ leverage through borrowings or acquire interests in companies with leveraged capital structures. The overall performance of the Fund's investments will depend in large part on the acquisition price paid, which may be negotiated based on incomplete or imperfect information. For a complete discussion of risks please review the Investor Memorandum carefully.